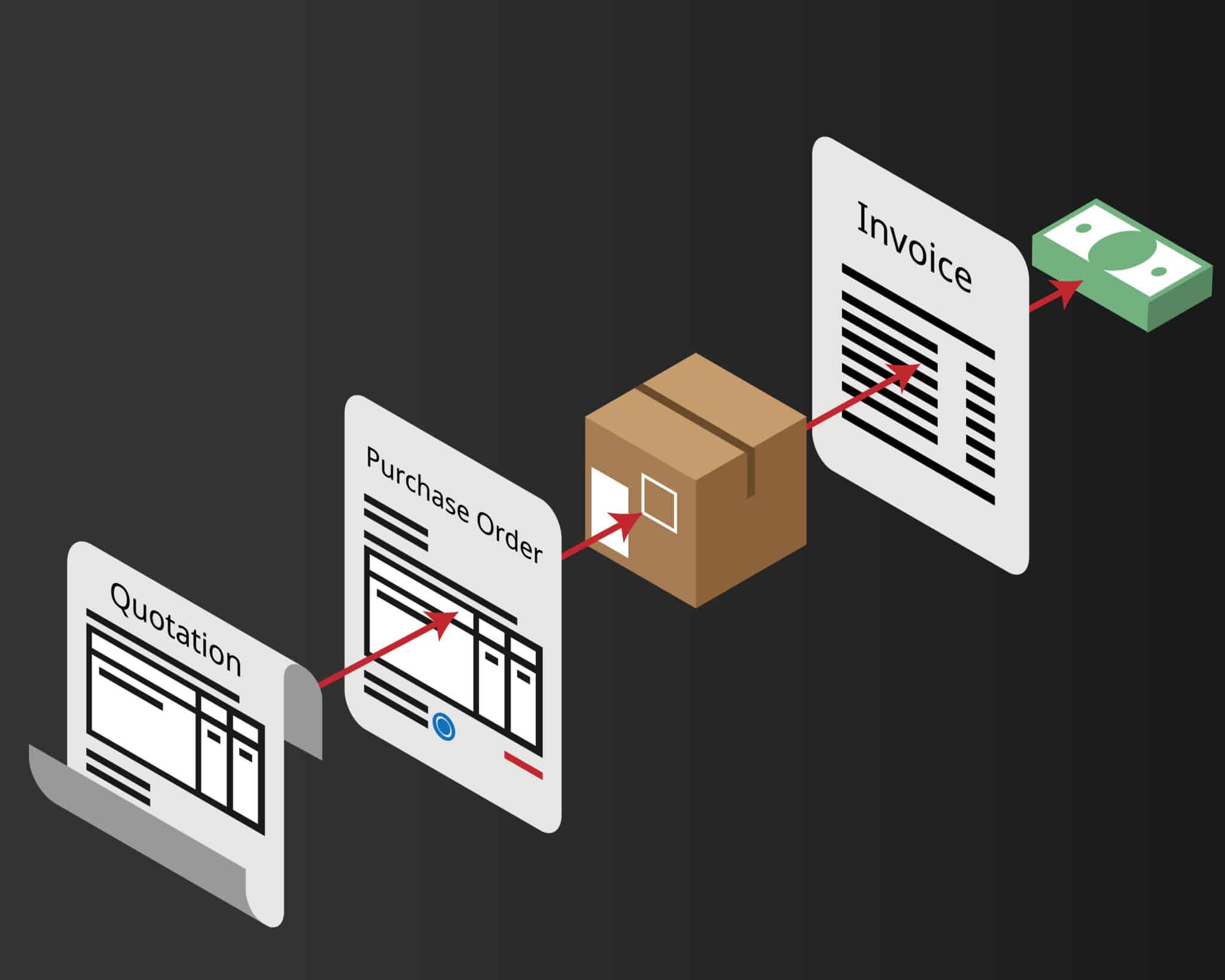

Installing a Procure-to-Pay solution is a serious performance driver for your company, plus it helps your purchasing and finance departments solve a number of issues. Overview of the eight advantages of getting a P2P solution at your organization.

#1 Boost productivity and save processing time

Choosing a P2P solution is an opportunity to greatly increase team efficiency and optimize the procurement process.

Purchasing tasks are quicker and easier when all your suppliers and their catalogs are centralized on the same platform. In just a few clicks, you can determine and approve the purchasing need, and send the supplier a purchase order.

Plus, screening and approval workflows combined with the scanning and OCR functionalities save your purchasing and accounting teams from doing tedious tasks that add no value. They can then spend that time on checking and verifying exceptions, orderless invoices, and other tasks that create value.

Take the example of our customer Radiall. After installing Basware’s P2P solution to optimize supplier invoice management, their average processing time went down from seven to four days.

Task automation also cuts down on input errors and duplicate entries, which directly helps shorten processing times and reduce incurred costs.

#2 Cut Costs

Amid price volatility, cost reduction is the key issue for purchasing and accounting departments.

As we mentioned earlier, reduced processing time and task automation make this possible. But there are other reasons!

More on this below, but one source of true savings is getting unapproved purchases under control. In fact, according to an Ardent Partner study published in 2022, these costs are known to be 6%-12% higher than for controlled purchases.

You should also factor in the savings on:

- Invoice reception

- Paper

- Printing

- Archiving and storage

When you look into how much you actually save, estimates say that an electronic invoice processed by P2P software costs 80% less than a paper invoice.

#3 Better visibility and management of expenses

You have to do more than reduce costs if you want to optimize and fully control spending. First, it’s essential to have crystal clear visibility of your entire Procure-to-Pay process.

This can be achieved by digitalizing and fully automating your processes because they standardize and centralize real-time processing of purchases and supplier invoices. It enables you to:

- Meet your budget forecasts by approving/denying expenses before they are incurred

- Anticipate cash flows based on real-time visibility and an overall view of spending commitments and payment orders, thereby helping you control working capital requirements

- Track expenses by category or supplier to align with your organization’s procurement strategy

#4 Meet your Payment Deadlines

For decades before the Covid-19 pandemic and the current geopolitical unrest, the balance of power between suppliers and customers had tended to lean towards the latter.

But the supply situation has become so precarious that now the goal is to be “your supplier’s favorite customer.” Losing a strategic supplier could spell disaster for a business, and in some cases even lead to bankruptcy.

These days, the suppliers your business depends on have to be “coddled”; you have to constantly work on keeping that close, trusting relationship alive.

Above all, this is done by meeting payment deadlines, which are all too often not honored.

There’s only one way to solve this issue: simplify and speed up the processing of supplier invoices by automating your processes!

#5 Use a P2P solution to limit unapproved purchases

Unapproved purchases are a real headache for your organization. And it’s easy to see why when you look at figures from a study by Manutan that reveals two major issues.

- Exorbitant costs: Unapproved purchases only account for 5% of all your company’s purchases, but make up 70% of processing costs. Moreover, only 11% of buyers say they have an annual schedule and stick to it. This lack of planning often results in last-minute purchases and the financial aspect is overshadowed when an emergency occurs in 18% of the companies without a provisional budget.

- Your teams waste time: 57% of buyers say their kneejerk reaction to internal customer requisitions turns the bulk of their orders into unapproved purchases.

When you deploy a P2P solution, you can take full advantage of the potentially untapped savings that unapproved purchases are eating up. You can also prevent risks by implementing several drivers:

- Centralize the supplier base and make it widely accessible on a single platform to cut the costs of a bloated supplier portfolio. It’s estimated that the annual cost of managing a supplier is $1,000.

- Set up order catalogs or trade marketplaces that offer preferential pricing and enable you to centralize your purchases in one secure channel for your trusted suppliers.

- Provide internal customers online forms to eliminate requisitions issued on paper or made through unapproved channels like bank cards and transfers.

- Implement approval workflows to screen each purchase for eligibility based on a clear purchasing policy.

Unapproved purchases also cause another problem when an unlisted supplier does not undergo routine reviews and no due diligence is done. This can pose severe risks to your organization.

#6 Ensure you’re complying with current regulations

Procure-to-Pay solutions are a wonderful tool for making sure your organization is compliant with all the regulations in force.

First, automating your P2P processes means every step of your supplier invoicing process is traceable from start to finish. It also facilitates and ensures that you create a reliable audit trail, which is essential in the event of a tax audit.

#7 Protect your organization from fraud

According to a 2023 TrustPair study, 50% of companies have been the victim of an attempt at “bank transfer fraud.” The main types of fraud are:

- Fraudulent invoices (37%)

- Fake bank detail statements (36%)

- Fake suppliers (32%)

- Internal fraud (20%)

These attempts are successful 25% of the time resulting in an average loss of $50,000.

What’s the cause? All too often, controls and approval processes are still being done manually, and paper documents are easy to falsify.

There’s also a matter of centralizing data in a supplier repository shared by the purchasing and finance departments.

#8 Make life easier for your employees and your company more attractive on the job market

Last but certainly not least, there is the advantage of making things more enjoyable and fulfilling for your employees, especially the purchasing department.

As we mentioned before, P2P solutions help do away with most low-value manual tasks by automating them and progressively using more artificial intelligence.

This gives your employees more time for tasks that add more value thereby making their jobs more rewarding. Their roles and functions in the company are changing. Whereas before they were limited to performing controls and checks, now they have more time to analyze results and forecasts. This means they can free up their strategic potential for company leadership and consult on projects, making them genuine business partners.

This is a huge advantage if you want to retain your employees and attract new ones, especially since we are currently experiencing one of the largest shortages of talent on the job market. Digitalization has truly become a recruitment driver!

While a Procure-to-Pay solution is a real boon for your company’s performance, it can cause internal upheaval. You need to prepare well to make the transition a success.

Backed by over 20 years of experience, the specialists at Fluxym have a tried-and-true method for guiding you before, during and after your P2P solution is integrated!