For businesses, installing a Procure-to-Pay solution is much more than just a technological upgrade. It’s actually a real strategic tool that the purchasing and finance departments have to implement and learn in order to solve the economic, financial, and legal issues they handle. But before setting up a P2P solution, learn more about it from the Fluxym specialists.

What is Procure-to-Pay?

Procure-to-Pay, or P2P, refers to a company’s purchasing and invoicing process. It creates a link between the purchasing, supply, and accounts payable functions.

The purchasing and finance departments work hand-in-hand from when a purchasing need is expressed to when the final invoice is paid. They make sure all the Procure-to-Pay steps explained below are well planned and designed to:

- optimize team productivity,

- control and reduce costs, and

- ensure the organization is compliant with current regulations.

The Steps of the Procure-to-Pay Process

Powered by automation software, the Procure-to-Pay process has just three main steps!

#1 The Procurement

- It all starts when a need is determined. Internal customers have access to products and services provided by suppliers on the company’s preferred vendor list, and they express a need. They place orders through catalogs, marketplaces or online forms.

- After the need is determined, an official purchase request is placed with the purchasing department and approved. If it does not comply with the company’s buying policy or is unjustified, it may be denied.

- Once a request is approved, a purchase order is created and automatically issued and sent to the supplier.

#2 The Delivery

- Delivery reception: When goods or services are delivered, the receiver checks it against the order. Do the quantities ordered match the ones received? Is the merchandise in good condition? Is the service provided the same as what had been sold?

- Receipt slip: Once the last step is completed, a receipt slip containing any feedback from the receiver is issued and forwarded to the company’s accounting department.

#3 Supplier Invoice Management

- Invoice reception: An invoice is created when an order to a supplier has been approved. It may be sent before, during or after delivery.

- Invoice processing: This is the last step in the Procure-to-Pay process. The invoices are converted into data that both humans and machines can understand. The goal is to be able to automatically compare them against the purchase orders and reception slips to ensure that the amounts to be paid match the amounts that were ordered and received. This is called automatic reconciliation or three-way matching (order, delivery, payment).

If there is a discrepancy between these three documents, for example the amounts do not match (an “exception”) or there is no purchase order (orderless invoice or “unapproved purchase”), the invoices undergo a thorough control and approval review.

If reconciliation of the three documents is approved, the following procedure takes place:

- An analytical allocation is automatically done to link the expense to the corresponding cost center (department, legal entity, business unit, etc.) and update budgets. This step then makes spending analyses easier and more robust.

- The person in charge of the expenditure receives an invoice for approval through a workflow that follows a list of criteria detailed in the company’s invoicing policy.

- The payment order is sent from the ERP to the accounting department.

- The invoice’s payment status is updated (denied, pending, approved) on the supplier’s portal giving them real-time visibility of all the processing statuses. It should be noted this saves considerable time by generating fewer emails and phone calls.

How is Procure-to-Pay different from Source-to-Pay?

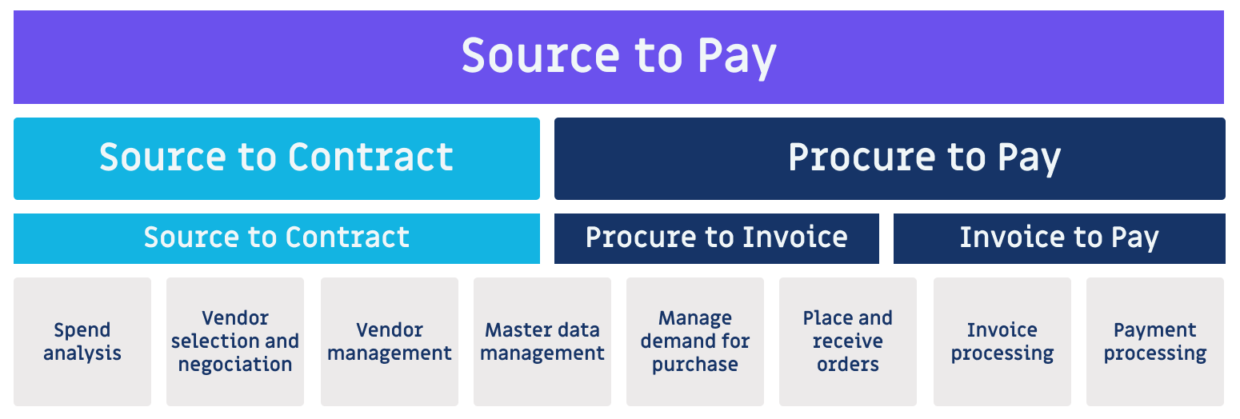

The P2P process includes all the steps mentioned above, whereas Source-to-Pay supplements it with an additional series of preliminary steps called Source-to-Contract:

- Supplier sourcing

- Supplier relationship management (SRM)

- Call-for-tender and contract management

Therefore, Source-to-Pay encompasses the steps in both Source-to-Contract and Procure-to-Pay. It’s a fully automated end-to-end purchasing management solution.

When you install a Procure-to-Pay solution at your company, you’re optimizing your purchasing process while helping your purchasing and finance departments solve a number of issues. Read our article on the benefits of P2P solutions for more information!